Canadian home sales are rising because prices are falling

Monday, Aug 18, 2025

Canadian home prises are rising because prices not interest rates are falling.

A shift is taking hold in Canada’s housing market, subtle enough to be missed in the noise yet powerful in its implications. Signals from July suggest a recalibration in the balance between buyer resolve and seller ambition.

National home sales climbed 3.8 per cent from June, marking the fourth straight monthly increase. Since March, transactions have risen 11.2 per cent, with the Greater Toronto Area leading the charge at 35.5 per cent growth over that period.

To the casual observer, it may look like the long-awaited recovery is here. In reality, this is a different kind of movement. The driver is not exuberance or a sudden easing of borrowing costs. The current lift in transactions is rooted in price adjustments, and that distinction matters more than it may seem.

This is especially apparent in CREA’s observation that an increase in transactions in the Greater Toronto Area played a large role in national sales volume moving up. We know that prices are falling most sharply in the GTA, so it would be fair to assume that there is a strong correlation between reduced prices, which lead to more affordability, creating more opportunity for buyers to enter the market.

Will the same trend be required for the remainder of Canada to see sales growth?

The narrowing of the gap

BMO Capital markets has been clear about what is holding the market back: the spread between what sellers want and what buyers are willing to pay. Robert Kavcic, senior economist, describes it as a “wide bid-ask spread” that has prevented the market from clearing, leaving listings to languish. The only durable remedy is to close that gap.

There are three theoretical ways to achieve it. The first is forced selling, which would require a deep recession, rising defaults, and job losses, a scenario neither imminent nor desirable. The second is a substantial drop in mortgage rates into the low three-percent range, requiring a cut of roughly 100 basis points from current levels. That path is considered improbable in the near term.

The third is price reductions. BMO regards this as the most realistic outcome. RBC reaches a similar conclusion, noting that moderating prices in several regions have delivered the greatest affordability improvement in three years, encouraging more buyers to act.

The evidence bears this out. July’s MLS® Home Price Index was unchanged from June but 3.4 per cent lower than a year earlier. In the GTA, values have fallen 5.5 per cent in 12 months; Vancouver is down 2.8 per cent, and Calgary, long an exception to the rule, now sits 1.8 per cent lower. The modest easing in prices has been enough to coax more buyers back into the market.

Price movements as the true lever of affordability

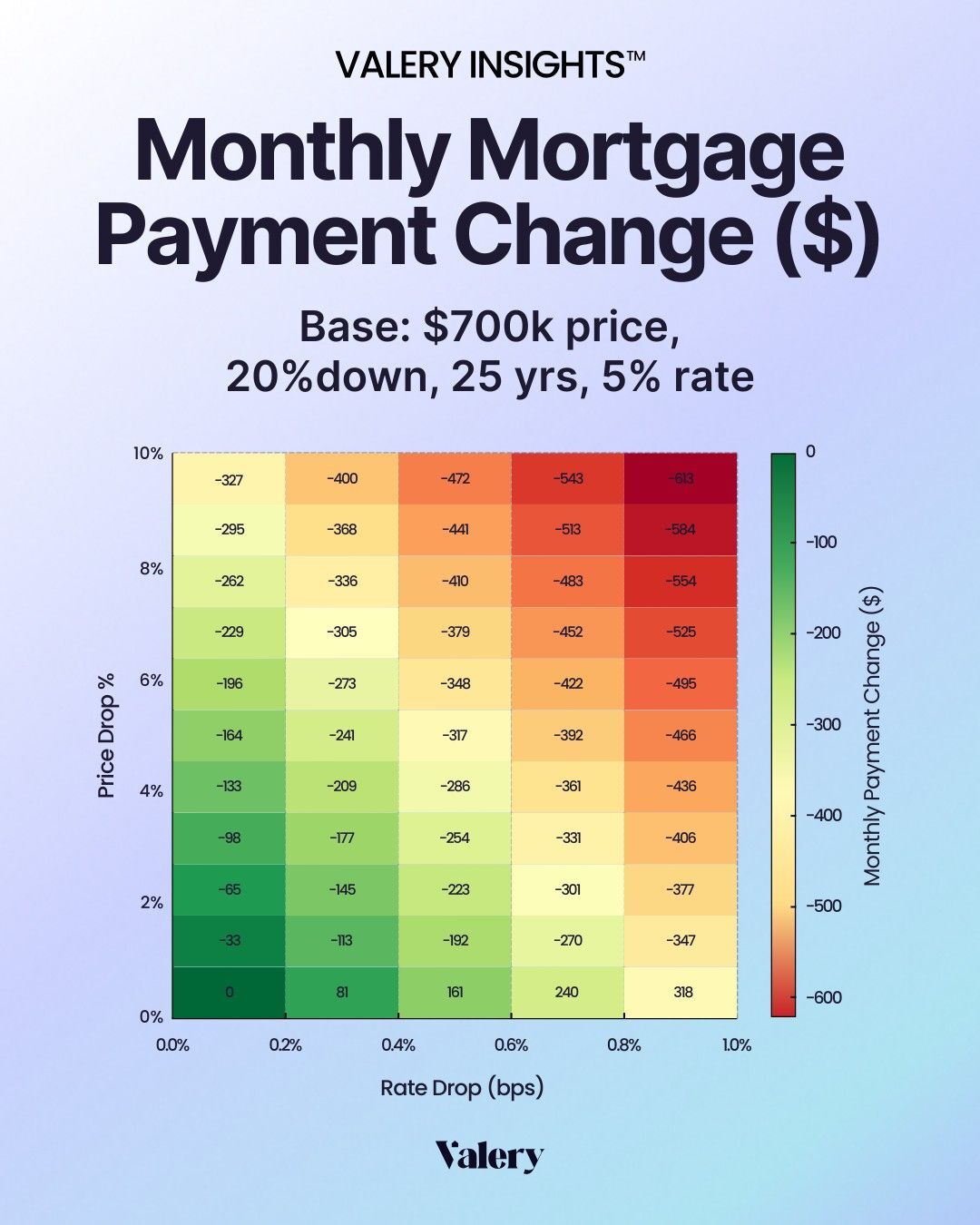

In the current interest rate environment, the arithmetic of affordability favours price declines over marginal rate cuts. Consider a $700,000 home with 20 per cent down, a 25-year amortization, and a five per cent mortgage rate. A five per cent drop in price reduces monthly payments by approximately $165. By comparison, a 25-basis-point rate cut on the same home saves about $58 per month.

The implication is straightforward: in the near term, further moderation in prices will have a greater influence on unlocking demand than incremental moves by the Bank of Canada.

Price growth patterns have varied sharply across Canadian cities. Toronto, Vancouver, and now Calgary have all recorded year-over-year price declines. Toronto’s price performance over the past five years is the weakest among major Canadian markets, up just over 15 per cent, while New Brunswick leads with an 80.9 per cent gain since July 2020. Over the past three years, Toronto has also experienced the sharpest price drop among major markets, whereas Quebec City has posted the strongest gains.

Canada’s split-screen inventory picture

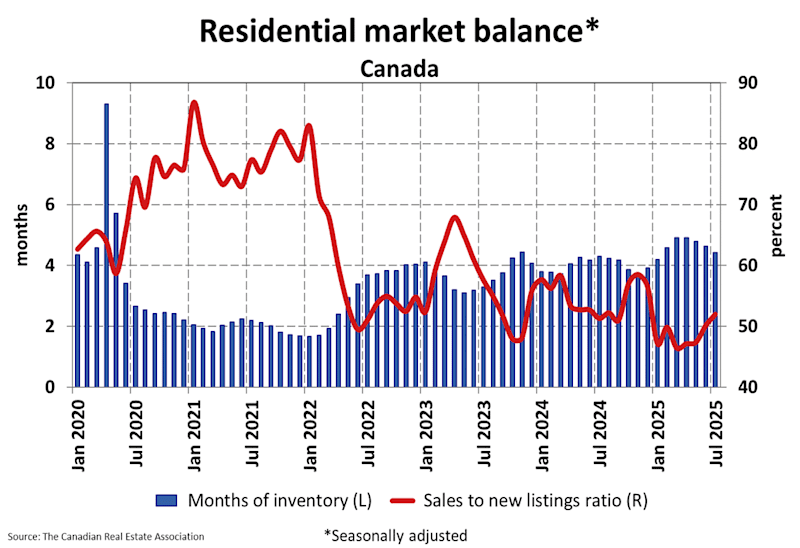

July’s new listings were essentially unchanged from June, but active inventory stood 10.1 per cent higher than a year earlier. Nationally, there were 4.4 months of inventory, a figure consistent with balanced conditions. Yet regional differences are striking.

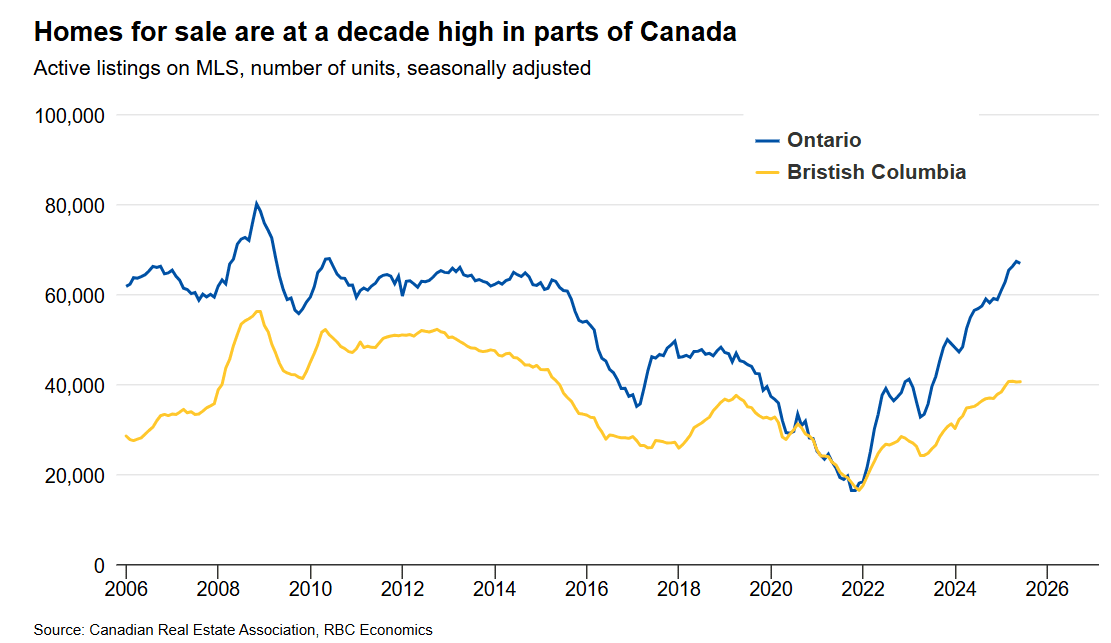

RBC Economics in the same report referenced above, notes that Ontario and British Columbia are carrying the highest inventory in a decade, a situation that has fostered intense competition among sellers and is expected to keep prices under pressure well into 2026. In the Prairies, Quebec, and Atlantic Canada, inventory remains tight, in some cases below pre-pandemic norms. These disparities explain why price corrections are unlocking demand in certain provinces while others remain buoyant.

September’s test and the path to a durable recovery

September’s influx of new listings will test the market’s resolve. CREA highlights this as a pivotal moment, when the balance between buyer demand and seller supply could either sustain recent gains or compel further price concessions.

The outcome matters because the recent lift in sales reflects opportunity rather than exuberance. With mortgage rates still high, price adjustments have been, and will remain, the most powerful lever for unlocking demand. In many major markets, values have eased just enough to restore a measure of affordability, drawing sidelined buyers back into the fold. For the Bank of Canada, the clearest path to a sustained recovery that does not reignite inflation lies in allowing this process of price normalization to run its course, rather than relying solely on marginal rate cuts.

by: Daniel Foch